September 24, 2025

/

Competitive Analysis: The Key to Strategic Advantage

In today’s highly competitive business environment, success depends on more than just having a great product or service. Companies need to understand where they stand in the market compared to others. This is where competitive analysis comes in.

Competitive analysis is the process of evaluating your competitors’ strengths, weaknesses, strategies, and performance. By conducting effective competitor research and using benchmarking techniques, businesses can identify opportunities, anticipate market trends, and refine their own strategies to gain a sustainable edge.

Why Competitive Analysis Matters

A well-executed competitive analysis provides several advantages:- Market Awareness: Understand trends, customer expectations, and industry standards.

- Competitive Edge: Identify gaps in the market that your business can fill.

- Benchmarking: Measure your performance against competitors to set realistic goals.

- Improved Strategy: Gain insights to refine pricing, marketing, and product development.

- Risk Reduction: Anticipate competitor moves and market changes before they impact your business.

Types of Competitive Analysis

To build a well-rounded strategy, businesses should explore different types of competitive analysis. Each type provides unique insights into market dynamics and helps identify growth opportunities.Direct vs. Indirect Competitor Analysis

- Direct Competitors: Companies offering the same product or service to the same target audience. Example: Two food delivery apps operating in the same city.

- Indirect Competitors: Companies that provide alternative solutions to the same customer need. Example: A fast-food restaurant can be considered an indirect competitor to a pizza delivery service.

SWOT in Competitive Analysis

Incorporating SWOT analysis into competitor research is an effective way to evaluate the market:- Strengths – Where competitors excel (e.g., pricing, customer service, technology).

- Weaknesses – Areas where competitors fall short (e.g., slow delivery, outdated website).

- Opportunities – Market gaps your business can fill (e.g., new customer segments, emerging trends).

- Threats – External factors that may harm your market position (e.g., new entrants, economic downturns).

Market Share & Positioning Analysis

Another critical aspect of competitive analysis is assessing market share and market positioning strategies. This involves:- Measuring your competitors’ share of the market using sales, revenue, or traffic data.

- Mapping out brand positioning to see how competitors differentiate themselves.

- Identifying gaps in positioning that can help your business stand out (e.g., premium pricing, niche targeting).

Competitive Analysis vs. Market Research: What’s the Difference?

While market research and competitive analysis are closely related, they serve different purposes. Market research focuses on understanding customers, market size, and industry trends. It uncovers insights about buyer behavior, preferences, and pain points using methods like surveys, interviews, and industry reports. This helps businesses identify opportunities, define target segments, and shape products or services that meet customer needs. Competitive analysis, on the other hand, zeroes in on evaluating competitors’ strengths, weaknesses, and strategies. It involves benchmarking, reviewing marketing tactics, studying pricing, and analyzing positioning to find gaps your business can exploit. In short, market research tells you what customers want, while competitive analysis shows you how to outperform rivals and using both together provides a complete foundation for smarter strategy and sustainable growth.Components of a Strong Competitive Analysis

To generate actionable insights, a competitive analysis must go beyond surface-level research and focus on specific areas that reveal market dynamics and business opportunities. Here are the key components every business should include:Competitor Identification

The first step in any competitive analysis framework is identifying both direct and indirect competitors. Direct competitors target the same audience with similar products, while indirect competitors offer alternative solutions that still meet customer needs. Mapping out competitors accurately allows businesses to understand the full scope of the market and build effective competitor research strategies.Product/Service Comparison

A detailed product and service comparison highlights differences in quality, features, and pricing models. This type of competitive benchmarking helps businesses evaluate where they stand against rivals and identify opportunities to differentiate their offerings. For instance, if competitors offer lower prices but weaker support, positioning your brand around premium service can become a winning strategy.Marketing Strategy Review

Reviewing competitors’ marketing strategies provides insights into their branding, messaging, and digital presence. By analyzing social media campaigns, SEO performance, and paid advertising, businesses can discover which market positioning strategies are most effective in the industry. This component also reveals gaps in messaging that can be turned into competitive advantages.Customer Feedback

Analyzing customer feedback and online reviews uncovers both strengths and weaknesses from the buyer’s perspective. Ratings, testimonials, and complaints show what customers truly value and where competitors fall short. Incorporating this data into your competitor analysis tools enables more customer-focused strategies and helps align offerings with real market expectations.Benchmarking Data

Finally, gathering benchmarking data allows companies to compare their own performance with industry leaders. Metrics such as sales, revenue growth, website traffic, and customer engagement provide a measurable way to track success. Using a structured competitive benchmarking framework ensures businesses set realistic goals, track progress, and continuously refine strategies for sustainable business growth.How to Conduct a Competitive Analysis

A structured approach ensures that your competitive analysis delivers actionable insights instead of just raw data. Here’s a step-by-step framework:Step 1: Identify Competitors

Start by making a list of direct competitors (businesses offering the same products or services) and indirect competitors (alternative solutions that meet the same need). This step is crucial for building a clear competitive analysis framework and understanding the full landscape.Step 2: Collect Data

Gather information using multiple sources such as websites, social media channels, financial reports, and customer reviews. Leveraging competitive analysis tools like SEMrush, SimilarWeb, or Ahrefs provides deeper insights into competitor performance, digital visibility, and keyword strategies.Step 3: Analyze Strengths and Weaknesses

Use a SWOT analysis approach to evaluate what your competitors do well and where they fall short. Strengths may include strong branding or efficient distribution, while weaknesses might be outdated technology or poor customer service. This type of competitor research helps you spot opportunities for differentiation.Step 4: Perform Benchmarking

Apply a competitive benchmarking framework to measure your performance against rivals. Compare metrics such as pricing, sales figures, market share, website traffic, and online engagement. Benchmarking not only highlights gaps but also provides a baseline for setting realistic growth goals.Step 5: Map Opportunities

Identify gaps in customer needs or areas where competitors are underperforming. For example, if reviews show slow response times across the industry, offering superior customer support can become a strategic advantage. This is how market positioning strategies emerge.Step 6: Develop Strategy

Translate insights into action by adjusting your marketing, pricing, or service offerings. The goal of competitive analysis in marketing is not just to collect data but to create a strategy that positions your brand more effectively and drives business growth through competitor research.Step 7: Monitor Regularly

The competitive landscape is dynamic, so a one-time analysis is not enough. Update your findings regularly—quarterly or when major market changes occur—to stay ahead. Using automated competitive analysis tools can make ongoing monitoring more efficient. Example: A SaaS company benchmarked its customer support response times against competitors and discovered they were slower. After improving response speed, customer satisfaction scores rose significantly.Top Tools for Competitive Analysis in 2025

The right competitive analysis tools can make the difference between surface-level insights and actionable strategies. In 2025, businesses have access to a wide range of platforms that support competitor research, benchmarking, and market positioning strategies.SEMrush

One of the most popular SEO and marketing tools, SEMrush allows businesses to track keyword rankings, analyze competitor websites, study backlinks, and uncover paid advertising strategies. It’s an all-in-one solution for building competitive benchmarking frameworks and improving online visibility.

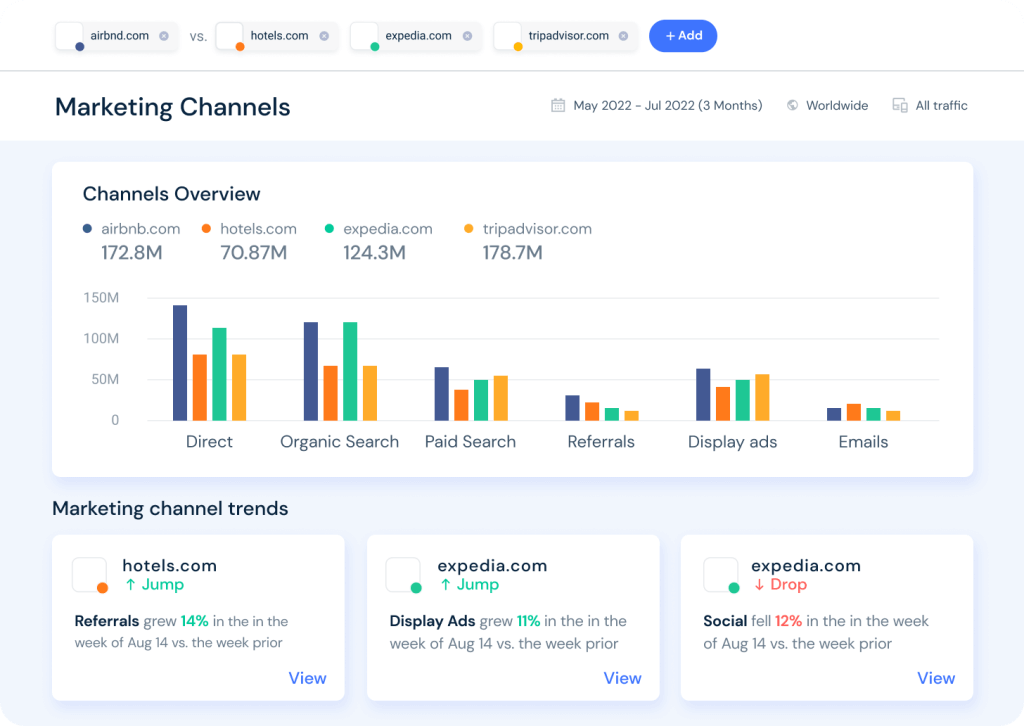

SimilarWeb

SimilarWeb provides in-depth traffic analytics, audience insights, and digital engagement metrics. It’s ideal for understanding market share, identifying leading channels, and mapping competitor analysis vs. market research insights at a global scale.

Ahrefs

Known for its powerful backlink database, Ahrefs is a must-have for competitor research in SEO. It shows which keywords competitors rank for, how much traffic they get, and where their links come from—essential for shaping market positioning strategies.

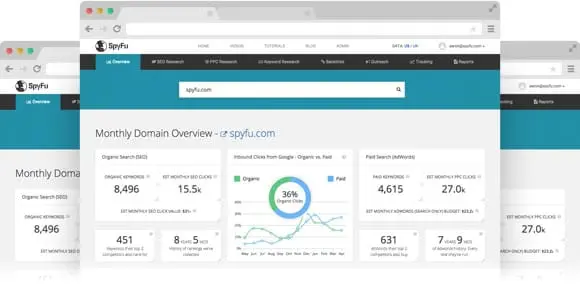

SpyFu

SpyFu specializes in uncovering competitor PPC and SEO strategies. Businesses can see which keywords competitors are bidding on, how much they spend on ads, and what content drives conversions. This tool is perfect for competitive analysis in marketing campaigns.

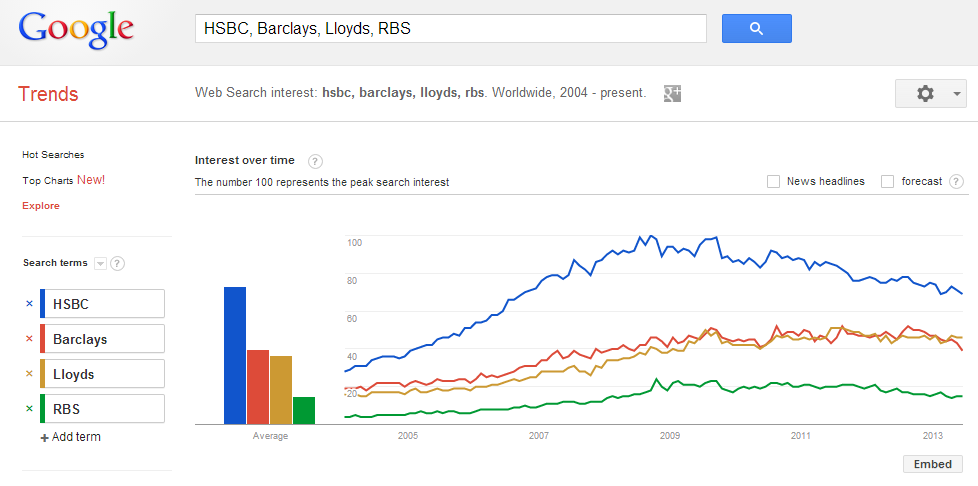

Google Trends

A free but powerful option, Google Trends helps businesses track keyword popularity, seasonal changes, and rising industry topics. It’s especially useful for market research methods and spotting early opportunities before competitors do.

Statista

For data-driven industry analysis, Statista provides reports, charts, and verified statistics across multiple sectors. Integrating Statista insights into competitive analysis frameworks helps validate decisions with reliable market data.

Best Practices in Competitive Analysis

- Stay Objective: Avoid assumptions—use verified data.

- Leverage Technology: Tools like SEMrush or SimilarWeb can provide deeper insights.

- Focus on Actionable Insights: Don’t just collect data—turn it into strategy.

- Update Frequently: Conduct analysis regularly to adapt to changing markets.

Case Study: Benchmarking for Growth

A Jordan-based e-commerce company wanted to strengthen its position in a fast-growing digital retail market. Although sales were steady, customer retention was lagging, and repeat purchases were below industry benchmarks. To address this, the company conducted a comprehensive competitive analysis of regional players using tools like SimilarWeb, SEMrush, and customer review tracking. Through this competitive benchmarking framework, they discovered that several competitors were leveraging loyalty programs and reward systems to keep customers engaged. These programs offered discounts, cashback, or exclusive offers for repeat buyers—something the company had not yet implemented. Recognizing this gap, the team introduced a tailored rewards program aligned with their own market positioning strategy. The results were measurable and immediate. Within the first quarter of launching the loyalty program, the company recorded a 20% increase in repeat purchases and higher customer lifetime value. Customer feedback highlighted that shoppers felt more appreciated and incentivized to return. This case study demonstrates how competitor research and benchmarking data can directly inform strategy, leading to sustainable business growth and a stronger competitive edge in e-commerce.Frequently Asked Questions (FAQ)

What is the difference between competitor research and competitive analysis? Competitor research is the data-gathering phase, while competitive analysis involves interpreting that data to build strategy. How does benchmarking help in competitive analysis? Benchmarking allows you to measure your performance against industry leaders and identify improvement areas. How often should businesses conduct competitive analysis? At least quarterly, or whenever major market changes occur. Is competitive analysis useful for small businesses? Yes, small businesses gain valuable insights that help them compete with larger players by finding niche opportunities.Conclusion

Competitive analysis is a powerful tool for businesses aiming to gain a sustainable advantage. By combining competitor research with benchmarking, companies can identify market opportunities, refine their strategies, and outperform rivals. In a fast-changing world, continuous analysis is the key to staying relevant, competitive, and successful.Ready to Outperform Your Competitors?

Don’t just watch your competitors grow—outsmart them. At Above Quality, we specialize in competitive analysis, market research, and benchmarking strategies that help businesses uncover opportunities, strengthen positioning, and drive measurable growth.

Contact Above Quality today and turn insights into results.

Recent Posts

abdelrahman.qazaer@gmail.com/0 Comments

Learn About Common Marketing Copywriting Mistakes

abdelrahman.qazaer@gmail.com/0 Comments

Social Media Takeovers: A Complete Guide for Brands, Creators, and Marketers

abdelrahman.qazaer@gmail.com/0 Comments